Veronica Daly is the Proprietary Director of Moneytree Finance, which she runs with her husband Con. With over 20 years’ experience as a mortgage broker, Veronica runs the mortgage department of the company.

Not for the first time in recent years, the price of renting in Ireland is in the news. Early in June, the government announced that it intends to extend Ireland’s existing Rent Pressure Zones (RPZs) nationwide, amid calls to do something about the ongoing housing crisis. With this in mind, this month I am addressing a question that many renters consider at one point or another: would it be cheaper, in the long run, to get a mortgage and buy?

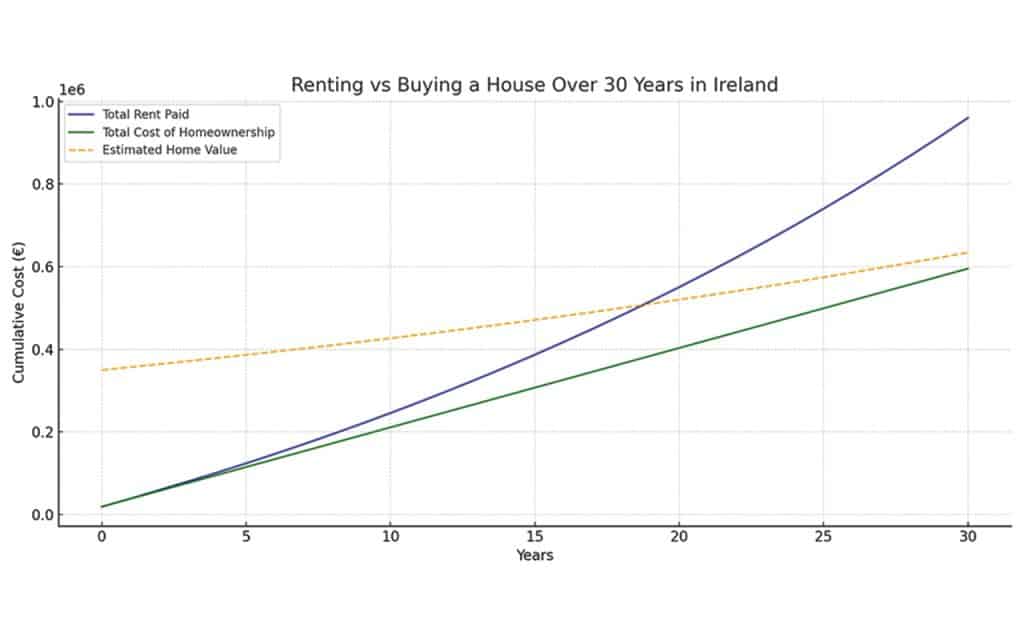

I want to argue that while purchasing a house is an upfront pain, one which can cause hardship for a few years, both before and after receiving a mortgage, renting is a rumbling, much longer-term pain. A typical example is outlined in the graph below, where the ‘blue’ line signifies rent paid, and the ‘green’ line represents the total cost of owning a home instead. As you can see, in the long run renting is much more costly: over a lifetime, the typical Irish renter at the centre of this example will pay approximately €900,000 in rent and still own nothing at the end!

Over a 30-year period, then, the implications of this crucial decision – rent or buy? –can significantly affect your overall wealth, financial flexibility, and lifestyle.

Of course, renting is not entirely without benefits. It can offer flexibility, lower upfront costs (i.e. no large deposit, stamp duty, or legal fees required), and the freedom to relocate easily for employment opportunities and family or lifestyle reasons. However, rental payments are subject to inflationary pressures and, as already noted, they do not build equity, meaning that a typical €900,000 spent on rent is a sunk cost – a big one! – with no return on investment.

Homeownership, meanwhile, involves higher upfront costs – mortgage deposit, legal fees, maintenance and taxes, to name the main ones – but unlike renting, it provides the opportunity to build equity and value. Over time, the cost of owning a home remains relatively stable compared to renting, and generally the home appreciates in value, as visualised by the ‘yellow’ line on the graph below. Over the course of 30 years, the home in this typical scenario has risen in value from just under €400,000 to around €630,000. Additionally, total out-of-pocket costs for homeowners over the same period hover just under €760,000, but unlike rent, this expenditure builds value. At the end of the mortgage term, the homeowner possesses a valuable asset that can be sold or inherited.

A person should also consider that, for the most part, mortgage terms end at age 68 (though they can go up to age 70 if a person is paying into a pension scheme through their employment). So, the monthly payments will cease as the person is retiring, meaning that somebody who lives into their nineties could have 20 years where they don’t have to pay for housing. Obviously, this same benefit is not available to renters, who will in many cases continue to pay for housing up until their day of death. Upon which, unlike homeowners, they will leave no property in their estate as an asset for their loved ones.

Choosing between renting and buying depends not only on financial readiness but also on lifestyle preferences, career stability, and long-term goals.

Over a typical adult’s lifetime in Ireland, buying a home generally leads to greater long-term financial benefit through property value growth and equity building – despite higher initial and ongoing maintenance costs. Renting, on the other hand, provides greater flexibility and lower entry barriers, but it comes at a higher cumulative cost and offers no tangible asset at the end.