Veronica Daly is the Proprietary Director of Moneytree Finance, which she runs with her husband Con. With over 20 years’ experience as a mortgage broker, Veronica runs the mortgage department of the company.

With the government push to become more climate aware, and the wider push for more sustainable products and lifestyles, the mortgage market has taken up the mantle and started to introduce rates, which reward those whose homes have better energy ratings.

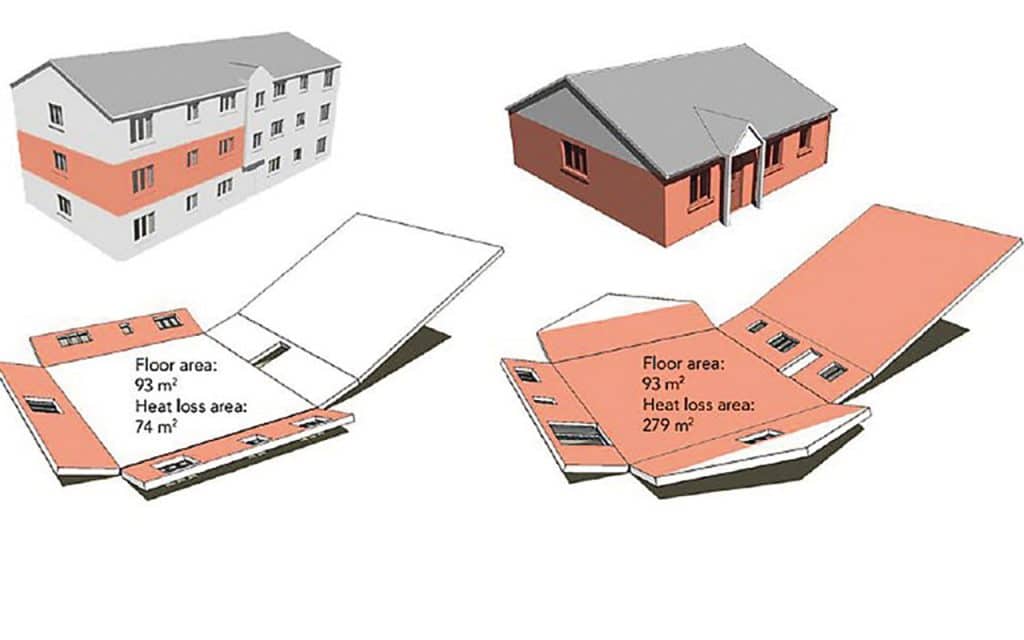

Residential energy use accounts for a significant portion of the country’s carbon emissions, so improving the energy performance of homes is a crucial step towards achieving Ireland’s climate targets. By incentivising higher BER ratings, Irish banks aim to help shift the market towards greener building standards.

For customers/mortgage holders, the benefits of a green mortgage extend beyond immediate financial savings on interest rates. Energy-efficient homes are more comfortable to live in, thanks to better insulation, modern heating systems, and often integrated renewable energy sources like solar panels. These features contribute to a healthier indoor environment, while reducing dependency on fossil fuels.

The expansion of the green mortgage’s availability is expected to have a ripple effect throughout the Irish market, spurring further interest in sustainable housing. As more homeowners become aware of the financial and environmental advantages, demand for energy-efficient properties is likely to grow. This, in turn, could drive improvements in construction practices and retrofitting efforts, creating a positive feedback loop of sustainability.

For the most part, the cheapest mortgage rates available to the mortgage market are for more energy efficient houses. To qualify for a green rate, a house must hold a BER rating above B3.

Last year, Bank of Ireland (BOI) changed the mortgage market by deviating from the normal loan to value lending structure. Loan to Value (LTV) is the percentage of difference between the value of the house and the value of the mortgage. Many lenders still use this practice, but BOI now works off the energy rating of the purchase property and they will reduce your interest rate by 0.05 per cent each BER value you move up.

Bank of Ireland are currently offering the cheapest green rates. However, as with most banks, the headline product, which is advertised, is normally the cheapest rate they offer, and even these come with specific terms and conditions. In this case, BOI’s cheapest rate is available only for those who are borrowing over 250K, with no cashback, a monetary incentive for taking out a mortgage. PTSB, meanwhile, offers a good mix of competitive rates with cashback, and their rates don’t punish those who have older houses, which are not as energy efficient. The AIB Group, however, are currently completely out of step with these market trends. The difference between qualifying for the AIB green rate and non-green rate can mean anything up 200 euros a month difference in a customer’s mortgage repayment.

To demonstrate the difference, take a typical 35-year term, €200,000 mortgage on a three-year fixed rate. A green rate of 3.1 per cent (50-80 per cent LTV) would cost the mortgage holder €780 per month, but if the house is BER rated C or below, the same mortgage at 4.8 per cent (50-80 per cent LTV) would cost €984 per month, a substantial difference of €204. This is how non-green rates really punish those buying/living in older houses.

It is important to note that only the ‘pillar’ banks – AIB, PTSB, and BOI – do green rates. This means that if your house is below a B3 BER rating, then the best rates available are actually offered by the non ‘traditional’ banks, such as Avant, Moco, ICS, or Núa Money. However, all these lenders are only available to potential mortgage applicants through a broker such as my company, Moneytree Finance, which has agencies with all of the above.

If an existing mortgage holder wants to upgrade their home to make it more energy efficient, in order to be able to qualify for better mortgage rates, the banks will require a BER certificate as proof. Thankfully, there are ways of getting finance in order to upgrade your home. One is to switch your mortgage and release equity for home improvements at the same time. At Moneytree Finance, we always advise people to re-look at their mortgage rate every three to five years, in order to ensure they are paying the cheapest rate available to them at the time. While switching, a homeowner could use that opportunity to do an equity release on their home and use the money to upgrade it. Depending on the amount of money required, banks will require proof that the equity released will be spent on home improvements, either through quotes or engineers reports. If your home is currently a low energy rating and you are borrowing to do extensive works, a bank may give you the green rate from the beginning on condition that an engineer confirms the works will bring the home up to or above B3 standard. Borrowing the money over a longer period time will also make it more affordable on a monthly basis.

Another way of raising finance is through a personal loan. The standard green home improvement loans can be up to vary from 6.4 to 8.2 per cent, however, and are normally repaid over the shorter period of five years, which obviously costs more on a monthly basis.

Finally, there is also the option of applying for a SBCI Home Energy Upgrade loan. The SCBI is short for Strategic Banking Corporation of Ireland, and the idea is to make energy efficient upgrades more affordable and accessible for homeowners. The rates are a lot cheaper than the banks’ own green home improvement loans, coming in at between 3.0 per cent and 3.9 per cent. However, to qualify for one of these loans, the works must be undertaken by an SEAI registered business, which has to provide an energy summary report at the application phase.

The expansion of the green mortgage is a win-win scenario for homeowners and the environment alike. Borrowers can secure a lower interest rate while reducing their energy bills, and the broader push towards energy efficiency supports Ireland’s transition to a more sustainable future.

If you would like to know more about green mortgage rates or how to finance home improvements, just give Moneytree Finance a call on 028 33 775.