ADVERTISING FEATURE

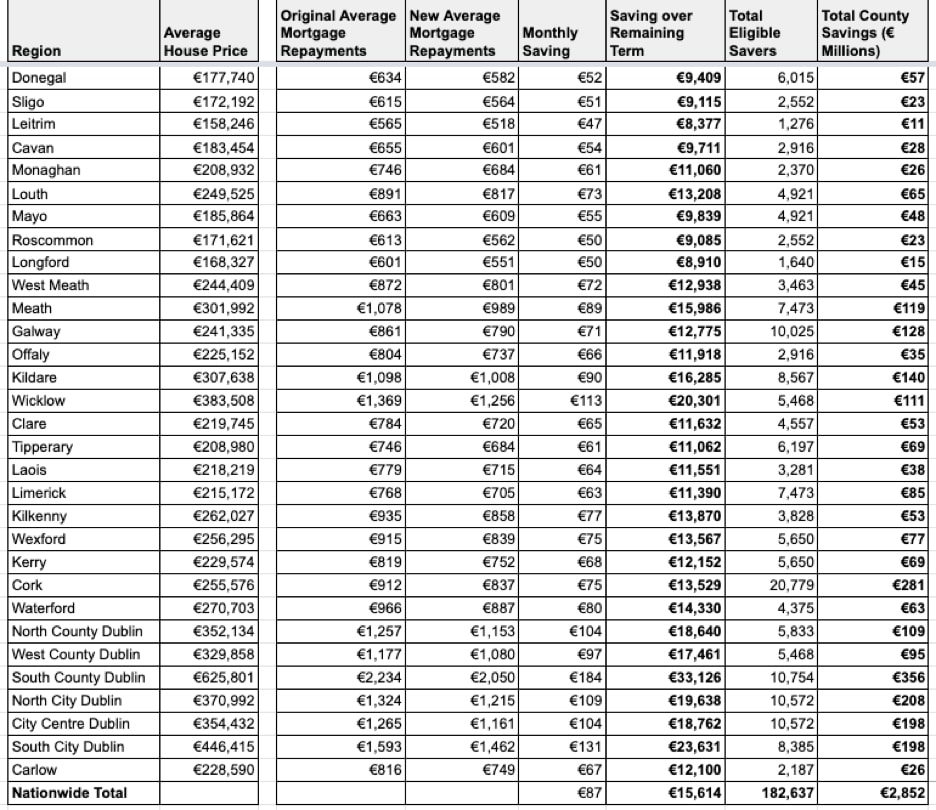

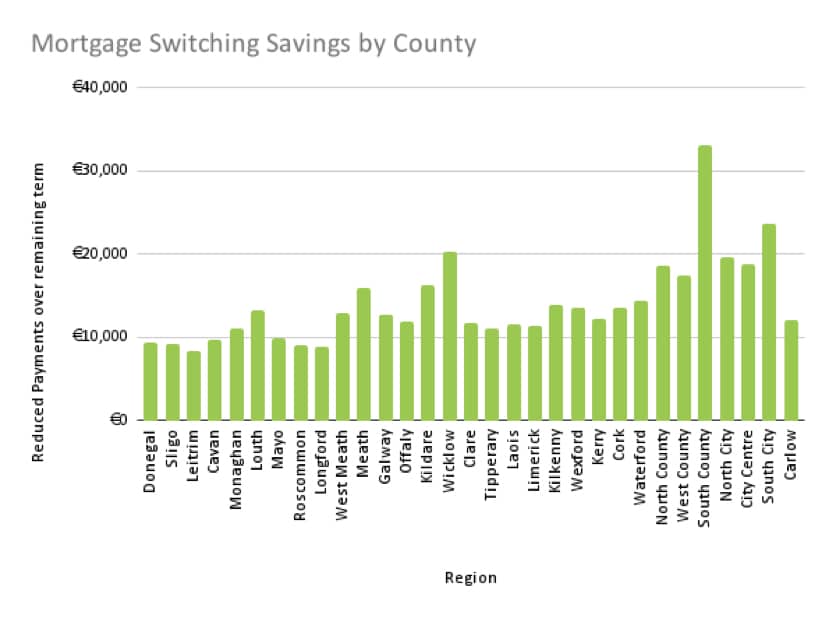

Over 180,000 households nationwide stand to save over €15,000 each by switching their mortgage. New analysis by moneysherpa.ie the Irish personal finance website has broken down how much could be saved county by county.

More than 20,000 switchers in County Cork will save over €13,000 by switching with €281 Million of savings across the county in total.

This contrasts with Leitrim which will save the least in the country with just 1,200 eligible switchers saving over €8,000 on average.

Savings have reached record levels due to a combination of rising house prices and falling mortgage rates for switchers. With higher house prices mortgage holders now have lower loan to values and can get lower rates.

According to the latest data from the Central Bank of Ireland standard variable rate mortgage holders are on a mortgage rate of 3.48%, despite fixed rates of 2.2% or less now being available.

Commenting on the analysis Mark Coan, Managing Director of moneysherpa.ie said “Our analysis highlights the massive opportunity people have to save by switching mortgage. Over a quarter of mortgage holders can save an average of €15,000 across their remaining term.”

“Mortgage switching is the single biggest thing most of us can do to get our finances in shape. If you aren’t on a tracker or fixed rate you should almost certainly switch.”

“As the cost of living crisis deepens, clawing back money lost through high interest payments can help lift the burden on households and inject money back into the local economy”

Most mortgage brokers offer switching for free and legal costs for switching are usually half that for your original mortgage.

County by County Breakdown