If you asked people what they regret most about money, you would probably expect to hear the usual answers. Spending too much when they were younger. Not saving enough. Wasting money on things they barely remember now.

And while those comments do come up, they are rarely the regrets that linger.

This time of year, especially after Christmas, money worries tend to feel louder. Credit card bills land, bank balances look smaller than expected, January pay feels a long way off, and the pressure of getting back to ‘normal’ can feel overwhelming. January has a way of forcing reality to the surface, whether we feel ready for it or not.

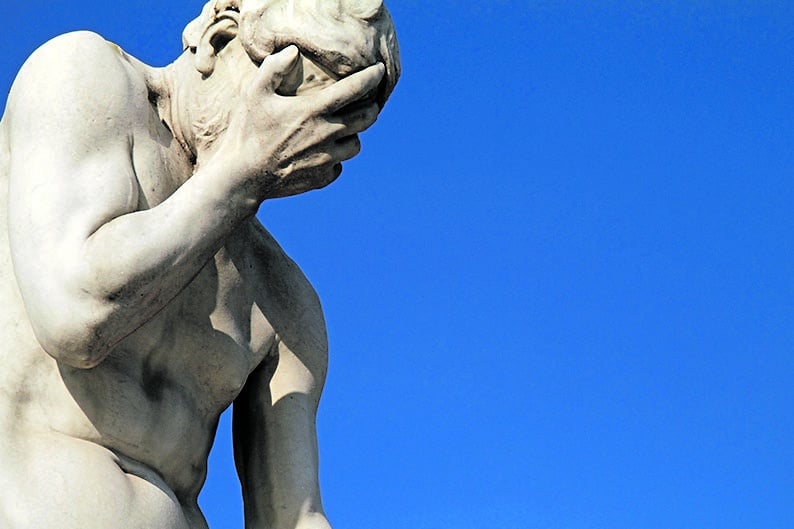

After years of honest, often emotional conversations with people about their finances, I have noticed something. The regrets that weigh heaviest are not about one bad decision or a few carefree years. They are about the things people quietly put off because life was busy, money felt stressful, or they believed they had more time.

The most common phrase I hear is, “I thought I’d deal with it later.”

Later when the kids were older.

Later when work settled down.

Later when there was a bit more money left at the end of the month.

After Christmas, that ‘later’ feeling can turn into anxiety. People feel guilty about spending, worried about bills, and unsure where to even start. Avoidance becomes tempting, but it often makes the stress linger far longer than it needs to.

One of the biggest regrets people share with me is around pensions. Not because they were reckless or careless, but because pensions felt confusing, boring, or like something meant for much older people. Many believed pensions were something to think about in their forties or fifties, or something they would deal with once life became more settled.

The regret is rarely about the amount of money they did not put in. It is about the time they lost.

Time is the most powerful part of any pension. Even small contributions made early can make a significant difference over the years. When people finally see this clearly, the regret is not anger, but disappointment in themselves for not knowing sooner.

“I didn’t realise how much of a difference even a small amount would have made.”

That sentence comes up again and again.

Another regret that often surfaces after life throws a curveball is not having protection in place. This is not an easy topic, and most people avoid it. Illness, injury, or death feel too heavy to think about when everything seems fine.

But when something unexpected happens, the regret is not about taking out cover. It is about the stress that follows when there is nothing there to ease the financial pressure. The worry about paying bills. The strain on a partner. The fear of how everything will be managed at an already difficult time.

People rarely regret protecting themselves or their families. They regret not doing it when life was calm and choices were easier.

Then there is the regret that surprises people most. Not having a plan.

Many people are not bad with money. They work hard, pay their bills, and manage month to month. But they do it without a clear picture of where they are going. Money goes in, money goes out, and life keeps moving without any real sense of direction.

When people finally sit down and look at the full picture, they often say the same thing.

“I thought I was terrible with money, but I just didn’t know what I was doing.”

That regret is not about savings or investments. It is about confidence and clarity.

What people rarely regret is enjoying their lives. They do not regret time with family, holidays, or the odd treat. What they regret is not having a structure that allowed them to enjoy life without the constant undercurrent of stress, especially during expensive times like Christmas.

The good news is that most financial regret does not come from being irresponsible. It comes from a lack of education, reassurance, and support. From not knowing where to start, or from feeling embarrassed to ask questions they think they should already know the answers to.

You do not need to have everything sorted. You do not need to be “good with money”. You just need to stop avoiding it.

Clarity changes everything.

If you are feeling the pressure after Christmas, start small. Look at what is coming in, what is going out, and what feels most stressful right now. You do not need to fix everything at once. Even understanding where you stand can make a huge difference.

A short conversation can help you prioritise what matters most, whether that is getting back on track after Christmas, putting a simple plan in place, or just knowing you are not missing something important. Sometimes the most practical step is simply asking the questions you have been avoiding.

Halpin Wealth Management offers free consultations. Visit www.hwm.ie or email info@hwm.ie to learn more.